In today’s automotive retail environment, financing plays a major role in closing deals. Most buyers aren’t walking into a dealership with cash, they’re relying on financing options to make their purchase possible. For dealerships, that means the faster you can determine a buyer’s financial readiness, the smoother the sales process becomes.

One tool that is helping dealerships accomplish this is AVA Credit. By giving both the customer and the sales team early insight into credit readiness, soft credit checks can play a major role in boosting loan approvals and improving the overall buying experience.

Let’s explore how soft credit pulls work and why more dealerships are using them to streamline financing conversations.

A soft credit pull is a way to check a person’s credit information without impacting their credit score. Unlike traditional hard credit inquiries, which can slightly lower a score and appear on a credit report, soft credit checks are completely risk-free for the consumer.

Soft credit pulls allow lenders or dealerships to view basic credit insights such as:

Because the check does not affect the customer’s score, shoppers are often more comfortable agreeing to it early in the buying journey.

For dealerships, this means they can gain valuable insight into a customer’s financing potential without creating friction in the sales process.

Understanding the difference between the two is important for both sales staff and customers.

Soft Credit Pulls

Hard Credit Checks

Soft credit pulls are not meant to replace the final credit application. Instead, they help determine whether a deal is likely to move forward before the dealership invests significant time structuring financing.

That early visibility is one of the reasons they are so effective at boosting loan approvals and improving efficiency.

Soft credit pulls don’t directly approve loans, but they create a much smarter process that increases the likelihood of successful deals.

When dealerships understand a customer’s credit profile early in the conversation, they can guide the buyer toward realistic financing options. This avoids situations where a deal falls apart late in the process.

Instead of guessing, sales teams can tailor the conversation based on actual credit readiness.

Soft credit checks help identify buyers who are more likely to secure financing. This allows sales teams to focus their time on the credit qualified leads who are truly ready to move forward.

As a result, dealerships spend less time chasing uncertain opportunities and more time closing real deals.

Without early credit insight, financing discussions often happen too late in the sales process. When credit information is available upfront, sales managers and F&I teams can structure deals much faster.

This helps reduce delays, shorten deal cycles, and improve the overall showroom experience.

Beyond boosting loan approvals, soft credit pulls also improve transparency for customers.

Today’s buyers want to understand their purchasing power before committing to a vehicle. A soft credit check allows them to see where they stand without worrying about damaging their credit score.

This creates several advantages:

Transparency is increasingly important in automotive retail, and soft credit pulls support a more open and customer-friendly buying journey.

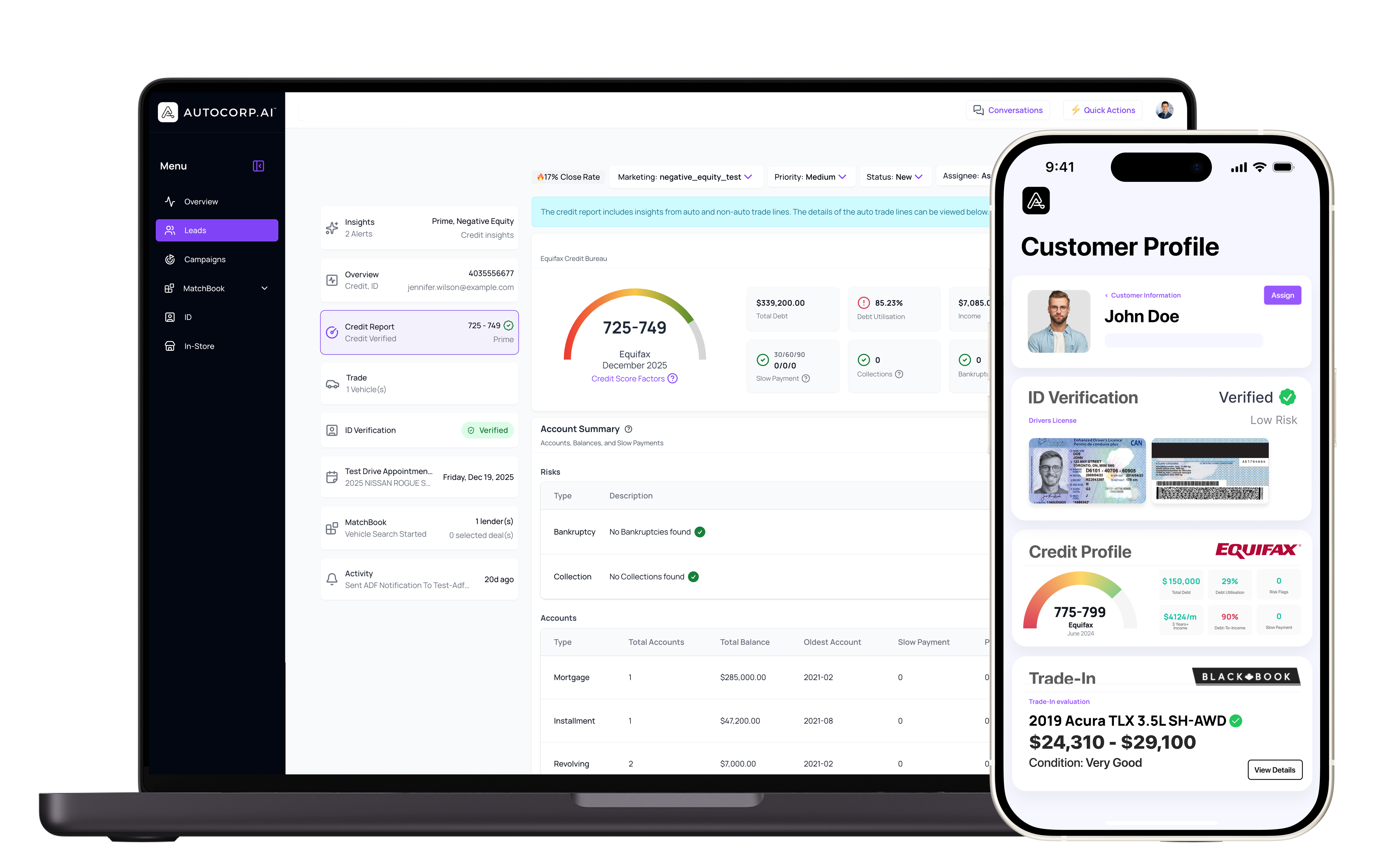

Many dealerships are now using tools like AVA™ Credit to incorporate soft credit pulls directly into their sales and marketing process.

AVA Credit™ allows shoppers to check their real Equifax credit score through a quick soft credit check that does not impact their score. The process is simple and can be completed online in seconds.

For dealerships, this creates a steady stream of credit-qualified leads before customers even step onto the lot. Sales teams gain early insight into a buyer’s financial readiness, which helps prioritize conversations and structure deals faster.

Rather than relying on guesswork, dealerships can engage with customers who already understand their credit position.

This not only helps boost loan approvals, but also improves efficiency across the entire sales funnel.

As automotive retail continues to evolve, the role of technology in financing will only grow.

Customers expect faster answers, more transparency, and less friction during the buying process. Soft credit pulls are helping dealerships meet those expectations while also improving internal efficiency.

By using soft credit checks early in the buyer journey, dealerships can:

In short, soft credit pulls are becoming a key tool for boosting loan approvals in modern dealerships.

When combined with solutions like AVA™ Credit, they help create a smarter, faster, and more transparent path from first inquiry to final approval.