In 2026, automotive retail continues to move faster, with buyers expecting transparency, speed, and digital-first experiences from the very first interaction. One of the most effective ways dealerships are meeting those expectations is by understanding a customer’s financial position early in the journey. That is where soft pull credit checks play a critical role.

Soft pull credit technology allows dealerships to pre-qualify shoppers instantly, without impacting their credit score or introducing friction into the buying process. When implemented correctly, soft pulls help sales teams focus on credit qualified leads, structure deals faster, and create a more confident and trust-driven customer experience.

A soft pull credit check is a type of credit inquiry that provides visibility into a customer’s credit profile without affecting their credit score. Unlike a hard inquiry, which typically occurs during a formal financing application, a soft pull:

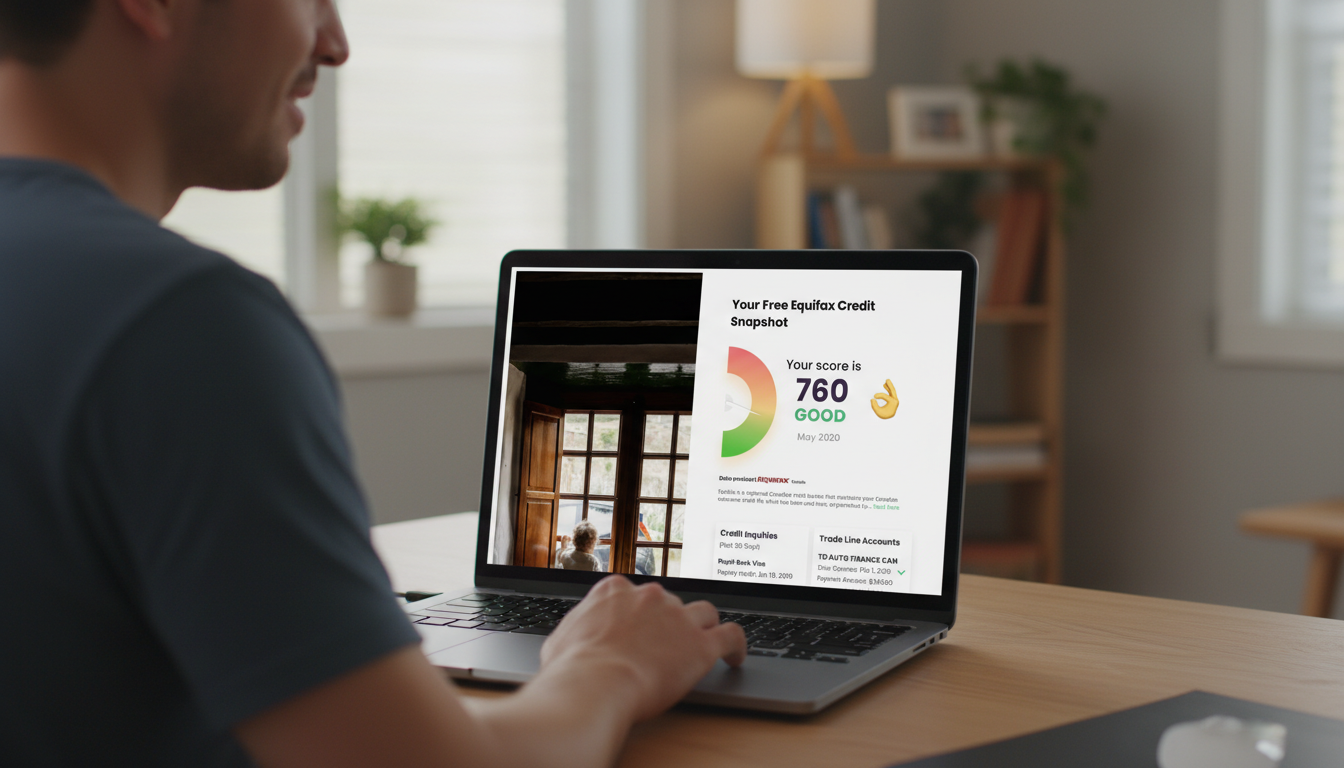

Modern automotive tools now allow dealerships to offer Equifax soft pull credit checks directly through their websites or in-store. With solutions like AVA™ Credit, customers can view their real Equifax credit score before speaking with a salesperson, creating a smoother and more informed buying journey.

Today’s buyers are more credit-aware than ever. Many shoppers hesitate to engage with dealerships because they fear unnecessary hard credit inquiries. Offering a soft pull option removes that hesitation and encourages earlier engagement.

For dealerships, this shift means fewer unqualified conversations and more time spent working deals that can realistically be approved.

One of the biggest inefficiencies in automotive sales is spending time with leads that are not financially positioned to move forward. Soft pull credit checks solve this by helping dealerships identify credit qualified leads early in the process.

With access to Equifax soft pull data, sales teams can quickly understand buying power and focus on vehicles and payment options that make sense. This reduces wasted effort and shortens the path from first contact to deal structure.

Trust remains a major factor in whether a customer chooses to continue the buying process. When a dealership offers a no-impact credit check, it signals transparency and respect for the customer’s financial situation.

Buyers feel more in control when they can check their credit without obligation, and that confidence often leads to stronger engagement and higher close rates.

Soft pull credit checks give F&I teams a head start. Instead of waiting until the final stages of the deal, dealerships already have insight into credit tier, potential lender options, and realistic payment ranges.

This allows financing conversations to happen earlier and more efficiently, reducing delays and helping customers move forward with clarity rather than uncertainty.

Understanding credit early makes inventory selection more strategic. When sales teams know what a customer is likely to qualify for, they can recommend vehicles that align with both budget and lender requirements.

This avoids uncomfortable surprises later in the process and keeps expectations aligned on both sides, which is critical for closing deals consistently.

Soft pull credit checks are also powerful digital conversion tools. When embedded into a dealership website, they give online shoppers a reason to engage beyond browsing inventory.

Instead of leaving to “think about it,” customers who complete a soft pull are raising their hand and signaling real intent. These leads are more informed, more confident, and far more likely to show up ready to buy.

Not all leads are created equal. A shopper who has completed a soft pull credit check has already taken a meaningful step forward. They have shared accurate financial data and shown readiness to explore real options.

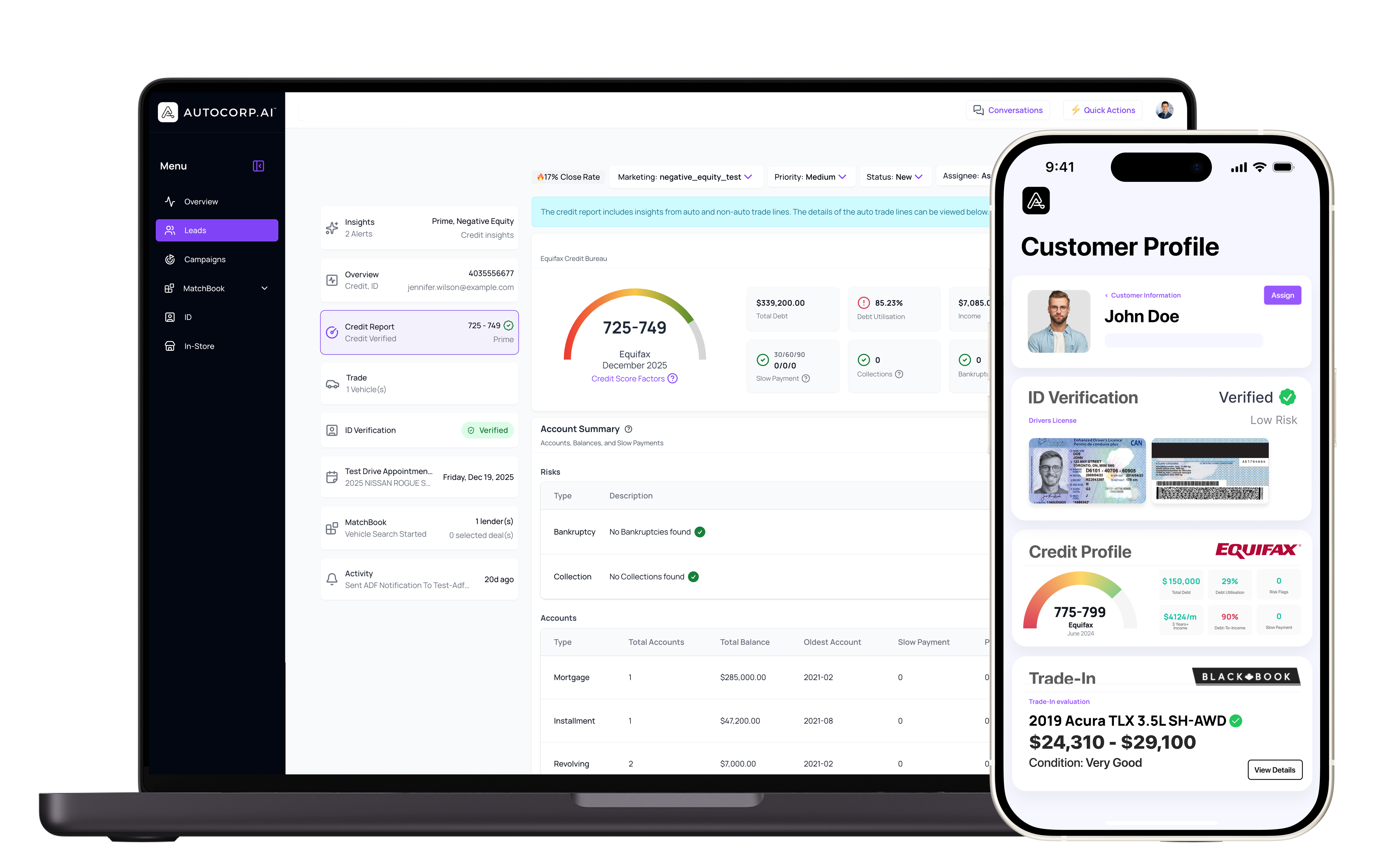

Platforms like AVA™ Credit are designed to turn this insight into actionable intelligence by delivering verified Equifax soft pull data directly to the dealership. This allows teams to prioritize follow-up, personalize conversations, and focus on deals that can actually close.

AVA™ Credit is built specifically for automotive retail workflows. Rather than acting as a generic credit widget, it integrates into dealership websites and systems to support both the customer experience and internal processes.

Key capabilities include:

The result is a smoother journey for the customer and a more efficient sales process for the dealership.

A soft pull credit check is a credit inquiry that gives visibility into a customer’s credit profile without affecting their credit score. It is different from a hard inquiry, which is usually tied to a formal finance application.

No. A soft pull does not impact the customer’s credit score. This is one reason it can reduce hesitation early in the shopping process.

In this article’s context, soft pulls typically do not require a Social Insurance Number. That reduces friction and can help shoppers feel more comfortable sharing info early.

They help teams qualify leads faster, start finance conversations earlier, and recommend vehicles that match the customer’s likely approval range. That reduces surprises late in the deal and keeps the process moving.

When shoppers complete a soft pull on your website, they signal higher intent than a basic form fill. These leads tend to be more confident and more ready to take the next step.

In 2026, soft pull credit checks are no longer optional for dealerships that want to compete. They help build trust, reduce friction, and bring clarity to one of the most important parts of the buying decision.

By offering Equifax soft pull credit checks and focusing on credit qualified leads, dealerships can spend less time guessing and more time closing. Tools like AVA™ Credit support this shift by aligning customer expectations with real financial data from the very beginning.

The dealerships winning today are the ones that make credit understanding easy, transparent, and customer-first.