In the fast-paced world of automotive sales, providing a seamless and transparent experience for customers is paramount. One innovation that has been transforming the industry is soft pull credit technology. As pioneers in this field, Autocorp.ai is excited to shed light on the benefits of integrating soft pull credit technology at your dealership. After all, our flagship product AVA™ Credit has helped hundreds of dealers across Canada originate over $800 million in auto loans, all through the power of soft pull technology!

Before delving into the advantages, let's identify the differences between soft-pull and hard-pull credit inquiries. A hard pull occurs when a lender or creditor checks a customer's credit report as part of a loan application process. These inquiries can impact the individual's credit score and remain on their report for up to two years. In contrast, a soft pull inquiry is a preliminary credit check that does not affect the customer’s credit score. It provides a snapshot of their credit history without leaving a mark on their credit report.

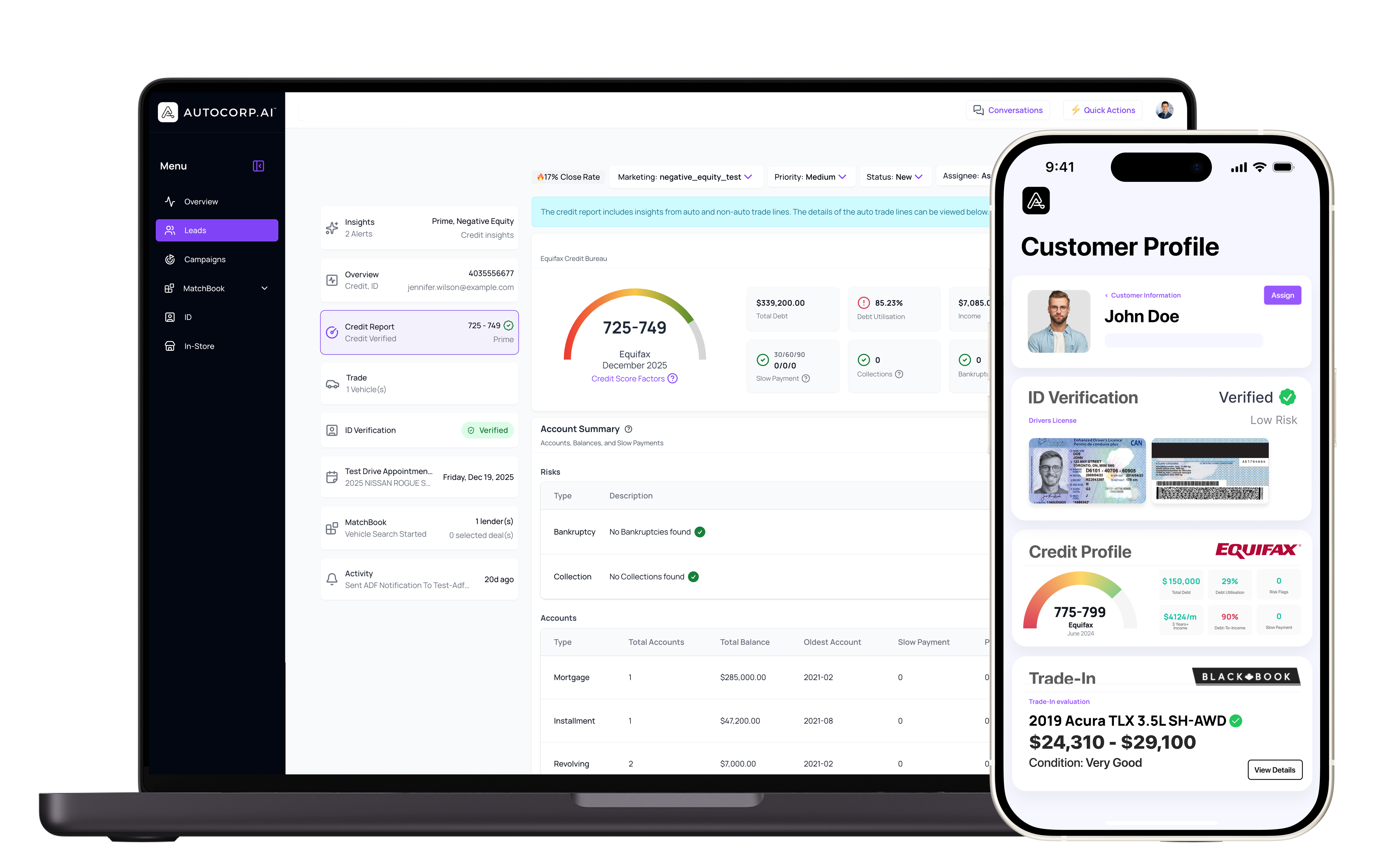

One of the key benefits of offering soft pull credit technology to customers is the ability to provide them with access to their Equifax credit score without impacting their credit. This transparency fosters trust and allows customers to make informed decisions about their financial situation. By offering this service on your website at no cost, dealerships demonstrate their commitment to customer satisfaction and empowerment.

Incorporating soft pull credit technology into dealership operations transforms the car buying experience for customers. Instead of waiting anxiously to learn about their creditworthiness after submitting a loan application, customers can proactively access their Equifax credit score. This not only reduces uncertainty but also enables them to explore financing options confidently. Moreover, by offering this service, dealerships differentiate themselves from competitors and position themselves as industry leaders in customer-centric practices.

Soft pull credit technology streamlines the financing process for both customers and dealerships. By providing customers with access to their Equifax credit score upfront, dealerships can pre-qualify them for financing options tailored to their financial situation. This proactive approach saves time and eliminates the need for multiple credit inquiries, thereby expediting the approval process. Additionally, by leveraging soft pull technology, dealerships can assess customers' creditworthiness accurately without impacting their credit score, ensuring a positive experience for all parties involved.

In today's competitive market, building trust and fostering customer loyalty are essential for long-term success. Soft pull credit technology like AVA™ Credit allows dealerships to establish transparent and honest relationships with customers from the outset. By offering them access to their Equifax credit score without affecting their credit, dealerships demonstrate their commitment to transparency and integrity. This level of trust not only enhances the customer experience but also encourages repeat business and referrals.

Soft pull credit technology lets a dealership run a preliminary credit check that does not affect the customer’s credit score. It gives a snapshot of credit history, so shoppers can see where they stand before moving into a full loan application.

A hard pull happens during a loan application and can impact the customer’s credit score, it can also remain on the credit report for up to two years. A soft pull does not affect the score and does not leave the same mark on the report.

Yes, the article states that soft pull credit technology can provide customers access to their Equifax credit score without impacting their credit. This gives customers clarity without the fear of a score drop.

When customers see their Equifax credit score upfront, the dealership can pre-qualify them for financing options that fit their situation. This can cut down on repeated credit checks and help the approval process move faster.

It builds trust by being transparent early in the process. Giving customers access to their Equifax credit score without affecting their credit shows the dealership is not trying to surprise them later.

In conclusion, soft pull credit technology continues to revolutionize the automotive dealership landscape by empowering customers, streamlining the financing process, and fostering trust and loyalty. As pioneers in this field, Autocorp.ai is committed to helping dealerships leverage the power of soft pull technology to enhance the car buying experience and drive success in the digital age. If you’re looking to start using soft pull credit technology at your dealership, book a demo on AVA™ Credit today!