The automotive retail landscape in 2026 is more competitive, data driven, and customer focused than ever. Dealerships face increasing pressure to protect margins, streamline operations, and meet higher buyer expectations. While many focus on prime credit shoppers, one of the most overlooked growth opportunities remains the subprime auto market.

Subprime buyers, typically defined as shoppers with credit scores below 620, make up a significant portion of today’s car buying audience. Industry data shows nearly one in three North American buyers fall into the non prime or subprime category. Yet many dealerships still hesitate to fully engage this market, leaving real revenue on the table.

The truth is that subprime buyers are not only viable, they can become a core driver of dealership growth in 2026 when approached with the right strategy, inventory, and technology.

Subprime buyers are customers with lower credit scores due to missed payments, higher debt to income ratios, or limited credit history. While some dealerships view these shoppers as high risk, the reality is very different.

Subprime buyers still need dependable transportation, are often highly motivated to purchase, and tend to remain loyal to dealerships that treat them fairly. As lending options continue to evolve, more financial institutions are offering programs designed specifically for subprime auto buyers.

When handled properly, subprime customers can become some of the most valuable long term relationships a dealership builds.

Economic pressures such as inflation, interest rates, and rising household debt are pushing more consumers into non prime categories. As a result, the subprime auto market continues to expand. Dealerships that ignore this segment risk missing a substantial share of potential buyers.

Subprime buyers who feel respected and supported are more likely to return for future vehicle purchases and service visits. They are also more likely to recommend a dealership to friends and family who share similar financial challenges. Trust earned with these customers often leads to long term loyalty.

When vehicles and financing are matched correctly, subprime deals can generate strong gross profit per unit. Dealers who understand how to structure these deals transparently can achieve healthy margins while still delivering a positive customer experience.

Many dealerships remain hesitant to focus on subprime buyers, which creates less competition for those willing to do it well. By positioning your dealership as welcoming and knowledgeable in subprime financing, you can stand out in a crowded market.

Subprime buyers are often cautious due to past experiences. Clear communication around pricing, financing options, and trade in values helps build trust early and reduces friction throughout the buying process.

Soft pull credit pre qualification tools allow dealerships to understand a buyer’s financial position without impacting their credit score. This helps sales teams set realistic expectations and focus on buyers who are truly ready to move forward.

Discussions around credit can be uncomfortable for buyers. Training sales and F and I teams to lead with empathy, patience, and professionalism helps create a more welcoming experience and increases close rates.

Inventory selection plays a critical role in subprime success. Reliable vehicles with affordable price points and manageable payments are more likely to convert and lead to satisfied customers.

Subprime customers will not always self identify. Targeted marketing campaigns should clearly communicate that your dealership offers pre qualification options, respectful service, and solutions for buyers with challenged credit.

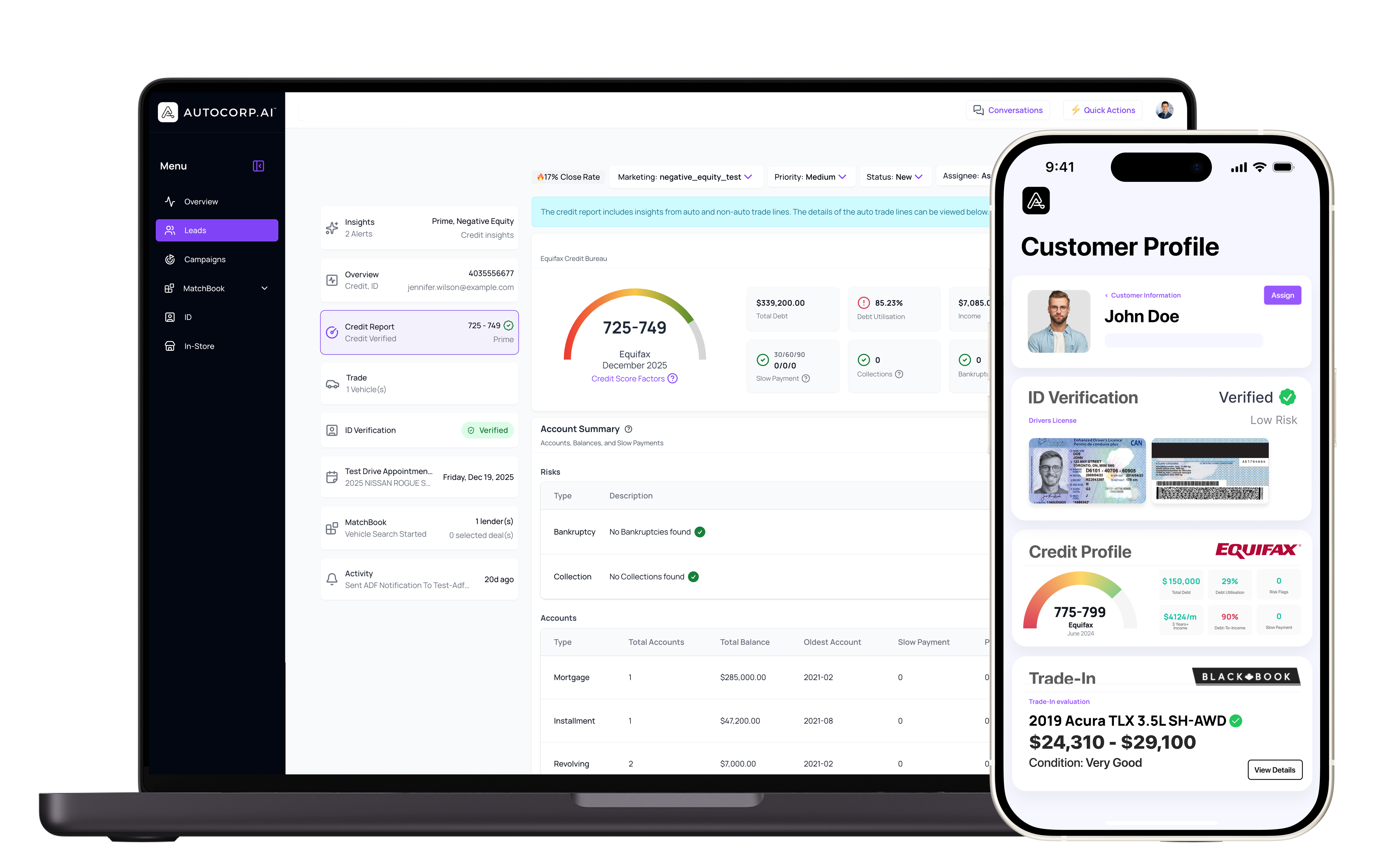

In 2026, modern automotive technology makes it easier than ever to serve subprime buyers efficiently and responsibly. Tools such as soft pull credit integrations, trade in calculators, CRM automation, and lead management platforms help dealerships streamline workflows and reduce wasted effort.

With better data and smarter systems, teams can identify qualified buyers faster, personalize follow up, and ensure compliance throughout the financing process. Technology allows dealerships to scale their subprime strategy without adding unnecessary complexity.

A subprime auto buyer is a shopper with a lower credit score, often below 620, usually due to missed payments, high debt-to-income, or limited credit history. Many still have steady need for a vehicle and strong intent to buy, especially when treated fairly.

More consumers are falling into non-prime categories because of inflation, interest rates, and household debt. Subprime buyers can also bring strong lifetime value through repeat purchases and service visits, plus referrals when they feel respected.

Use clear pricing, plain-language financing explanations, and honest trade-in discussions. Subprime shoppers often come in guarded, so a respectful tone and zero “gotcha” fees reduce friction and increase close rates.

Reliable vehicles with affordable prices and payment-friendly terms convert best. When the car, payment, and lender fit together from the start, you get happier customers and fewer deal headaches later.

Soft-pull credit pre-qualification tools help set expectations without harming credit scores. Trade-in calculators, CRM automation, and lead management tools also help teams respond faster, focus on qualified buyers, and track steps that support financing compliance.

Subprime buyers are not a challenge to avoid. They are an opportunity to grow unit sales, improve profitability, and build lasting customer relationships. Dealerships that embrace this segment with transparency, the right inventory mix, and modern technology can unlock meaningful growth.

As auto retail continues to evolve beyond 2026, the dealerships that succeed will be those that stop overlooking subprime buyers and start treating them as a key part of their long term strategy.