Auto loan rates remain elevated in 2026, and affordability continues to dominate buyer conversations. Higher borrowing costs, tighter lending guidelines, and longer loan terms have reshaped how consumers approach vehicle purchases.

For dealerships, this environment presents both pressure and opportunity.

While some buyers hesitate or delay purchases, others are still ready to buy, they just need clearer guidance and smarter financing structures. Dealerships that adapt their strategy to today’s rate environment can protect margins, improve close rates, and strengthen customer trust.

Here’s how to stay competitive as auto loan rates remain high.

Interest rates have fundamentally changed buyer behaviour. Monthly payments are higher than they were just a few years ago. Approval standards in certain credit tiers have tightened. Lenders are paying closer attention to debt-to-income ratios and overall risk.

As a result, dealerships are seeing:

The sales approach that worked in a low-rate environment does not translate directly into today’s market. Success now depends on structure, transparency, and speed.

In 2026, affordability drives decisions more than ever. Buyers are less focused on MSRP and more concerned with what fits their monthly budget.

Rather than discussing price in isolation, present structured payment options early in the conversation. This can include:

When customers see clear pathways that match their financial comfort zone, resistance decreases.

Soft-credit pre-qualification tools help establish realistic buying power before the deal advances too far. This reduces late-stage surprises and keeps conversations productive.

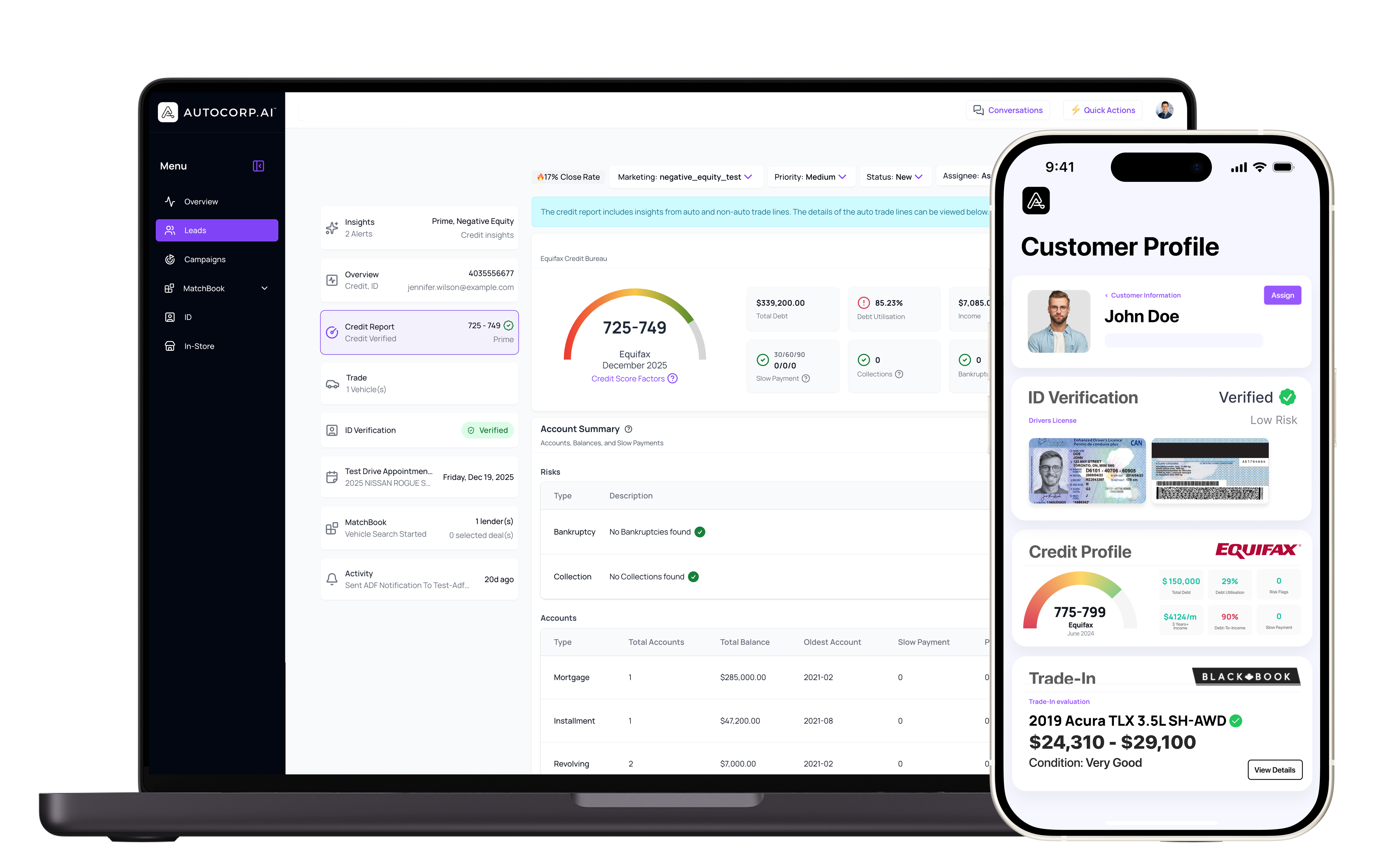

Solutions like AVA™ Credit allow dealerships to offer no impact credit checks early in the process, helping identify credit-qualified buyers before they reach the F&I office. Instead of structuring deals blindly, your team can have informed conversations based on real financial data.

When customers understand what they can afford upfront, the entire process becomes more efficient.

One of the biggest challenges in a high-rate environment is deal collapse due to mismatched inventory and approvals.

A customer may love a vehicle, but if it does not align with lender guidelines or payment capacity, the deal stalls. Time is wasted restructuring and renegotiating.

Smart dealerships use data to quickly match:

By combining early credit insight with structured vehicle matching, dealerships reduce guesswork and improve close rates.

In complex scenarios such as subprime credit or negative equity, fast and accurate vehicle alignment becomes even more critical. The faster a team can present viable options, the higher the likelihood of closing.

Rising auto loan rates have amplified the consequences of poor internal communication.

When sales and finance operate in silos, customers experience delays, unexpected payment changes, and deal restructuring late in the process. That frustration often results in lost sales.

Aligning sales and finance earlier in the customer journey improves outcomes by:

When sales teams have visibility into credit insights early, and finance managers are looped in sooner, the process becomes smoother and more predictable.

In a high-rate market, clarity is competitive advantage.

When interest rates are higher, buyers fixate on APR. While rate matters, it should not dominate the entire discussion.

Successful dealerships help customers understand total value and total cost of ownership.

Highlight factors such as:

A vehicle with slightly higher financing costs may still provide better long-term value if operating expenses are lower.

Training sales teams to shift from rate anxiety to value-based discussions builds trust and positions the dealership as an advisor rather than just a seller.

In 2026, dealerships that rely on instinct alone fall behind. Data-driven decision-making is essential in a tighter financing environment.

Track and analyze:

With tools like AVA™ Credit feeding verified credit insights directly into your workflow, reporting becomes more actionable. Managers can see not just how many leads are coming in, but how many are credit-qualified and realistically fundable.

The more visibility you have, the more strategic your approach becomes.

Rising auto loan rates are not temporary obstacles. They are part of the evolving retail landscape. Waiting for rates to fall is not a strategy.

Dealerships that thrive in 2026 are those that:

High interest rates increase complexity, but they also reward discipline and structure.

When your team adapts, communicates clearly, and uses smarter financing strategies, you do more than close deals. You build trust in a market where buyers need guidance more than ever.

The rate environment may be challenging, but with the right approach and the right tools, your dealership can turn pressure into performance.

Higher borrowing costs and tighter lending guidelines have increased monthly payments and raised approval standards in some credit tiers. Lenders also pay closer attention to debt-to-income and overall risk, which changes who qualifies and how deals need to be structured.

Shift to affordability-first selling. Start with realistic payment options, show multiple term lengths and down payment scenarios, and be ready with vehicle options that fit the buyer's budget and likely approval terms.

Soft-credit pre-qualification helps confirm realistic buying power early, without impacting the customer's credit score. That reduces last-minute surprises in F&I, cuts down on deal rewrites, and keeps the conversation focused on options the customer can actually finance.

Match the right vehicle to the right approval by aligning inventory pricing with lender requirements, approved loan terms, and the customer's credit tier. Early credit insight makes it easier to present viable options fast, especially for subprime buyers or negative equity situations.