In today’s competitive auto retail landscape, dealers can’t afford to waste time on low-intent leads, unrealistic shoppers, or customers who never had the credit strength to buy in the first place. As digital retailing expands and more buyers begin their journey online, dealerships need better information, smarter tools, and deeper customer insights. That’s why the industry is shifting toward a new standard: Credit Qualified Leads (CQLs).

While traditional internet leads offer only surface-level interest, a Credit Qualified Lead provides verified financial readiness, real buying power, and insight into what a shopper can actually afford. If standard leads are guesses, CQLs are the proof. As market conditions tighten and fraud attempts grow, understanding this distinction is becoming essential for every dealership.

This blog breaks down the real difference between a lead and a Credit Qualified Lead, why the shift matters, and how solutions like AVA™ Credit are transforming the buying experience for dealers and customers alike.

For decades, a dealership internet lead has been the same thing: a name, a phone number, and a vague expression of interest. Whether it comes from a form fill, a trade-in request, a chat widget, or a “contact us” page, these leads can show some intent but lack almost everything needed to determine if a buyer can realistically move forward.

Most dealers know the problem well:

A lead might tell you someone is interested, but interest doesn’t close deals, credit readiness does.

A Credit Qualified Lead goes far beyond surface interest. It confirms whether a shopper has the financial capability, lender fit, and real readiness to buy.

A Credit Qualified Lead typically includes:

-Is the shopper a real person?

-Have they passed digital ID verification?

-Identity confidence reduces risk before the deal even starts.

This is the core difference. A Credit Qualified Lead includes a soft credit check or other verified financial insights that confirm:

This isn’t a guess, it’s real, usable information.

Instead of a shopper saying, “I want a $50k SUV,” the dealership knows:

This aligns expectations early, reducing friction later.

A true CQL includes intelligence that shows which lenders are most likely to approve that customer and at what terms. This helps the dealership:

A credit-qualified shopper has taken a clear step forward by approving a soft pull or submitting credit information. This signals higher intent than a basic form fill.

Since approvals, lender fit, and payment confidence are confirmed early, the deal moves significantly faster, often in a single visit.

In short, a Credit Qualified Lead eliminates guesswork and replaces it with verified data.

Dealerships aren’t just looking for more leads anymore. They’re looking for leads that convert.

Here’s why Credit Qualified Leads have become the new standard:

When you know a shopper’s credit readiness, you can focus your time on real buyers instead of low-quality inquiries.

No more chasing customers who were never realistically in the market.

Customers appreciate transparent payment accuracy, realistic approval expectations, and being matched to the right vehicle quickly.

When deals go to the right lenders the first time, everyone benefits, especially F&I.

If a shopper thinks they can afford a vehicle but can’t qualify, it derails the process. CQLs prevent misaligned expectations.

Dealerships with CQLs have cleaner funnels, cleaner handoffs, and more streamlined sales cycles.

Traditional leads didn’t evolve with the market. Credit Qualified Leads did.

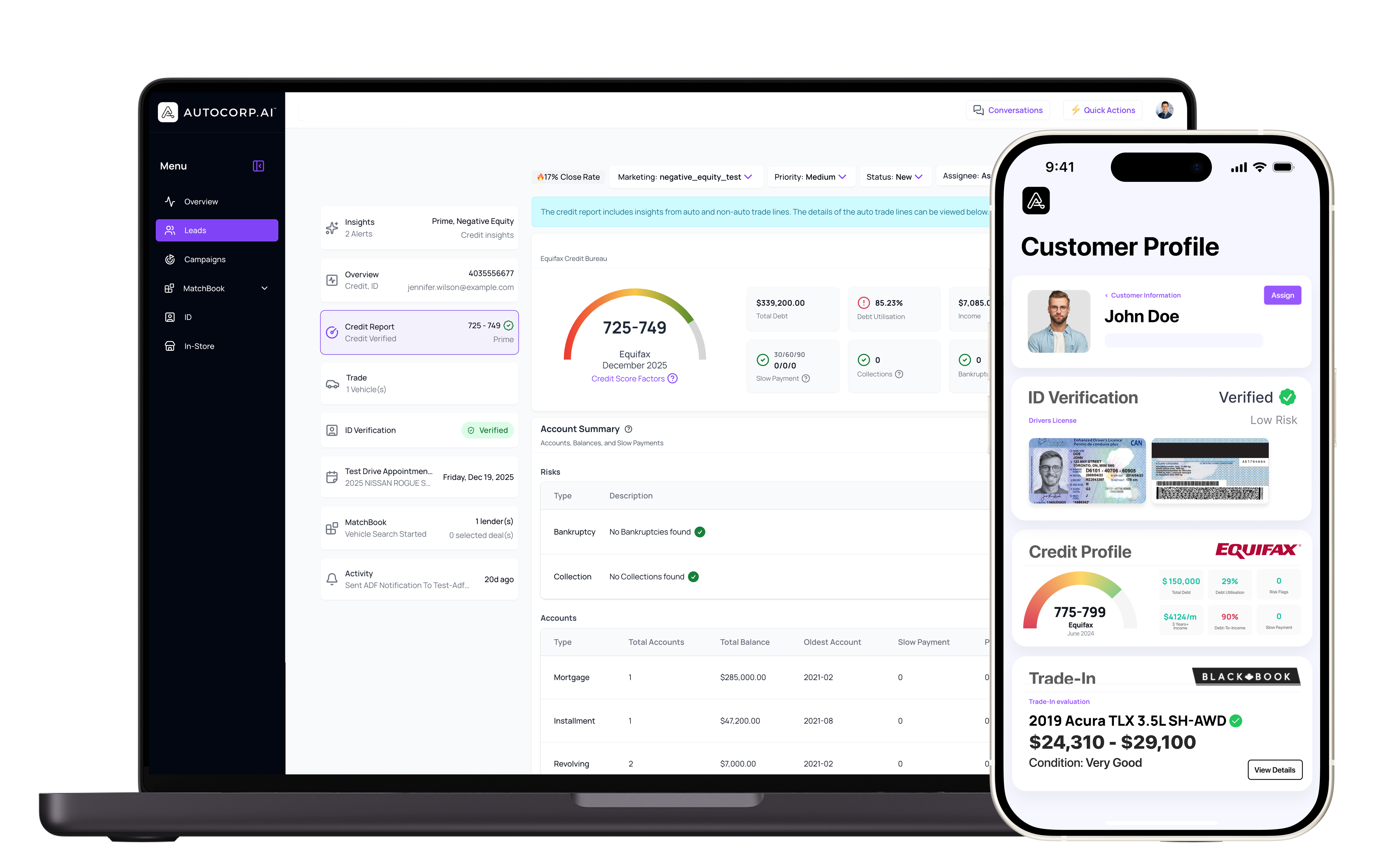

Most tools claim to “improve lead quality,” but AVA™ Credit elevates it entirely. It provides dealerships with true Credit Qualified Leads, backed by verified financial insights that move deals faster and smarter.

Here’s how AVA™ Credit does it:

This removes hesitation and increases participation while giving dealers real credit data.

You know what the customer can afford, not what they think they can afford.

Sales and F&I teams get structured insights on credit tier, income ranges, payment compatibility, and lender fit before any paperwork begins.

With full financial context upfront, the dealership can begin conversations at the right price point and move the customer to a vehicle they’re truly eligible for.

AVA™ Credit turns browsers into real buyers by helping dealerships focus on the shoppers who are financially ready to make a purchase.

As the auto industry becomes more digital and more competitive, dealerships must prioritize quality over quantity. A name and phone number aren’t enough anymore. Dealers need verified financial readiness, and that’s exactly what Credit Qualified Leads deliver.

By embracing CQLs, dealerships create:

And with AVA™ Credit, generating Credit Qualified Leads is simple, seamless, and integrated directly into your sales and F&I workflow.

The future of lead generation isn’t just about capturing interest. It’s about capturing qualified buyers and Credit Qualified Leads are the path forward.