Car dealerships, with their valuable inventory and customer financial information, are attractive targets for criminals who specialize in identity theft. From falsified loan applications to disappearing vehicles, dealerships often discover they've been defrauded long after the deal is done. Let's explore ways to prevent this.

Key Takeaways

- Require two valid IDs, verify addresses, and train staff to spot tampered documents.

- Use identity verification software, check credit with consent, and add facial recognition only with privacy safeguards.

- Validate loan applications, confirm income and employment with employers, and watch for synthetic ID red flags.

- Apply extra checks for remote buyers, avoid sight‑unseen deals, and flag above‑market offers.

- Keep thorough records, train staff often, and report suspected identity theft to law enforcement.

1. Strengthen Your ID Verification Process

- Two Forms of Valid ID: Require a government-issued photo ID (like a driver's license or passport) and secondary proof of address (such as a utility bill or bank statement).

- Scrutinize IDs: Train staff on how to carefully examine IDs for signs of tampering. ID checking guides and tools can be found on government websites like the Department of Homeland Security: https://www.dhs.gov/real-id.

- Address Verification Services: Consider using services like Melissa Address Verification: [invalid URL removed] to match the customer's address with their ID.

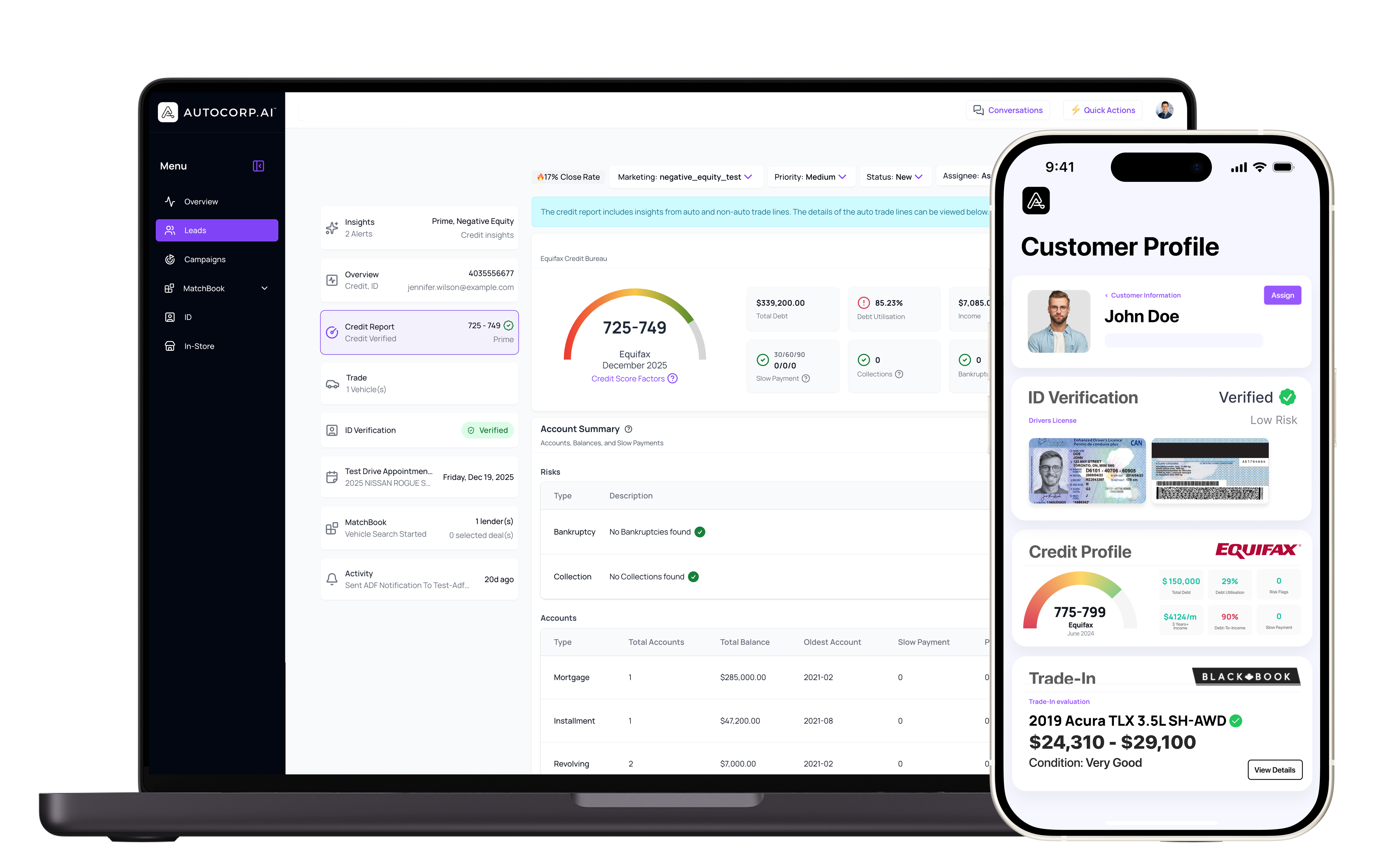

2. Embrace Technology

- Identity Verification Software: Invest in software like IDology: https://www.idology.com/ or Acuant: https://www.acuant.com/ to automate and strengthen your verification processes.

- Facial Recognition: While privacy concerns must be carefully considered, secure facial recognition solutions can be an added layer of verification.

- Credit Report Scrutiny: With the customer's consent, use reputable services like Experian: https://www.experian.com/ or Equifax: https://www.equifax.com/ to review their credit report, verifying income and employment consistent with the loan application.

3. Scrutinize Loan Applications Closely

- Synthetic Identity Fraud Red Flags: Beware of inconsistencies on applications, misspellings, or slight address variations. Learn about synthetic ID fraud from the Federal Trade Commission: [invalid URL removed].

- Verify Employment and Income: Contact employers directly. Don't solely rely on self-reported income on applications.

- Caution with Third-Party Financing: Be aware of risks, verify the legitimacy of the company, and understand their verification procedures.

4. Be Cautious with Out-of-State or Distant Buyers

- Local Buyers are Best: If possible, prioritize local buyers who are easily accessible for in-person verification.

- Extra Verification for Remote Buyers: Implement video conferencing, additional ID checks, and stricter scrutiny of applications for out-of-state or long-distance buyers.

- Avoid Sight-Unseen Offers: Offers to buy a vehicle sight-unseen, especially at above-market prices, should raise alarms.

5. Maintain Detailed Customer Records

- Document Thoroughly: Securely store copies of IDs, loan applications, and all customer communication.

- Suspicious Activity Reporting System: Train staff to recognize suspicious behavior and have a clear reporting system in place.

- Cooperate with Law Enforcement: Report any suspected identity theft to authorities and assist any investigations fully.

6. Invest in Employee Training

- Identity Theft Awareness: Educate staff on common identity theft scams and red flags to look out for.

- Verification Procedure Training: Ensure thorough training on your dealership's specific procedures and use of any identity verification technology.

- Emphasize Reporting: Stress the importance of escalating suspicious activity to designated supervisors.

Frequently Asked Questions About Car Dealership Fraud Prevention

What is the most effective first step to prevent identity theft at a dealership?

Require two forms of valid ID, then verify address details. Train staff to inspect IDs for tampering and use official guides like DHS REAL ID resources. Pair manual checks with an address verification service for added confidence.

How should dealerships validate loan applications to avoid synthetic identity fraud?

Check for mismatched names, addresses, and odd spellings. Verify employment and income directly with employers, not just the application. If third‑party financing is involved, confirm the company’s legitimacy and their verification procedures.

What technology should a dealership use for identity verification?

Adopt an identity verification platform to automate ID checks. With consent, review credit through reputable bureaus like Experian or Equifax. Consider facial recognition only as a secondary layer and handle privacy concerns with clear policies.

How do you handle out‑of‑state or remote buyers safely?

Use video calls to confirm identity, collect additional ID, and apply stricter verification. Be cautious with sight‑unseen offers and deals that come in above market price. Require more documentation and slow down the process if red flags appear.

What records should be kept if fraud is suspected?

Keep copies of IDs, loan materials, and all customer communications in secure storage. Use a clear internal reporting process for suspicious activity and cooperate with law enforcement when identity theft is suspected.

Conclusion: Stay Vigilant

Identity theft schemes are constantly evolving. Commit to robust procedures, ongoing staff training, and staying informed on the latest fraud tactics to protect your dealership from costly losses. Book a demo with us on AVA ID today and safeguard your dealership from fraudsters!